The Dow Jones Industrial Average is down below 10,000, the S&P 500 Index is off, and in the last year the Nasdaq has lost more than half of its value! Americans are hanging onto Federal Reserve Chairman Alan Greenspan's every word, and wondering whether President Bush is helping or hurting the stock market.

Unless you're about to retire and have placed all your eggs in the "tech" basket, there is no cause for panic. Economists tell us that the U.S. economy is taking a break after a decade of phenomenal growth in profits and "irrationally exuberant" market values. Although sections of the stock market have tumbled rather dramatically over the past year, American business and industry is doing just fine. It's our economy that wags the stock market, not the other way around, and we have every reason to expect that the U.S.-based stocks in aggregate will continue to provide the 11 percent average annual long-term return that they have offered since 1925. Better than a CD, huh?

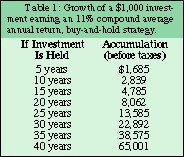

If you're a long-term investor (and you probably ought to be), today's market situation should be a source of delight. Excellent companies with wonderful long-term prospects are selling at discounts. Bargains abound, making it easy to follow that old maxim, "buy low, sell high." Of course, as a long-term investor, you're not interested in selling anytime soon, if ever. (A long-term investor is someone with a 10-15 year investment horizon, or longer.) You should hope that the market will dip even lower, and remain depressed until just before you start spending your nest egg. (But don't count on it.) Just in case you've forgotten what an 11 percent long-term return means, here's a refresher. If you invest $1,000 now, you could reasonably expect the returns noted in Table 1. And, the longer your investment is held, the more likely these predictions are to be accurate.

Of course, you're not just going to make a one-time investment. As a long-term investor, you understand the magic of "dollar-cost-averaging." By investing a constant dollar amount at regular intervals (e.g., every month, or every paycheck), you will take maximum advantage of the peaks and valleys in market prices, and will end up paying a lower-than-average price for shares in your stocks or stock fund. When the market becomes overpriced (as it was throughout the late 1990s), your dollar will buy fewer shares, and when the market falls off (as it's doing at the time of this writing), your dollar will pick up extra shares at bargain prices. Lovely!

If you're already dollar-cost-averaging, for instance, through your clinic pension program, IRA, or your college's 403(b) payroll deduction plan, all you need to do in this environment of irrational gloom is "stay the course!"1 One can neither "time the market," nor otherwise accurately predict the ebb and flow of stock prices in the near term, so why try? Now is the time to reap the benefits of simplicity in investing. Instead of panicking because the total value of your portfolio has decreased these past 12-15 months, now is the time to recommit to your long-term investment plan. If you feel you must do something, then increase the amount that you are dollar-cost-averaging. Just dribble it in on a regular basis. It's that easy.

If you haven't yet implemented your long-term investment plan, this is certainly an excellent moment in stock market history to get started. When asked what he thought was mankind's greatest invention, Albert Einstein reportedly answered without hesitation: "compound interest." The magic of investing in the stock market is based on compounding, which is the reinvesting of dividends and capital gain distributions. Compounding, in turn, depends on time. Time is the greatest single factor in determining the long-term success of your investing plan. The sooner you implement your investing program, the greater the time available to work the magic. Today would be a good day to start; yesterday would have been even better. Time is of the essence!

Have you held off starting because you don't know enough to be able to select good investment opportunities? Not to worry, since you can obtain good performance, maximum diversification and low expense with nothing more complicated than low-cost, broad-based, no-load stock and bond index funds. Good, sound, simple investing is not rocket science; several excellent introductory books provide more information than most of us will ever need to do well in the market.1,2,3

Long-term investors are well advised to exercise benign neglect. Ignore all those money magazines and investment newsletters. Turn off that financial news network. Walk away from hot stock tips or any other potential investment that you don't understand. Decline any offers for margin trading, penny stocks or commodities. Keep investing simple and automatic, and you'll sleep well at night. You've worked hard as a DC to earn money through your profession; it's time to let your money do the work for you.

References

- Bogle JC. Common Sense on Mutual Funds. New York: John Wiley & Sons, 1999.

- Tobias A. The Only Investment Guide You'll Ever Need. San Diego: Harcourt Brace & Company, 1998.

- Tyson E. Personal Finance for Dummies. Third edition. Foster City CA: IDG Books, 2000.

Arlan Fuhr,DC

Phoenix, Arizona

Click here for previous articles by Arlan Fuhr, DC.