While attending to office items, the telephone rang and it was the office manager for a chiropractic practice informing me that the principle, Peter, had taken ill and was rushed to the hospital.

This info comes on the heels of another practicing physician named Brian who recently discovered he had cancer. While he is able to fight it through treatment, he needed assistance with his practice. These stories then remind me - who minds the practice when illness strikes?

It is one thing to create a practice and develop it. But, as with any other business, it becomes necessary to create succession plans. Just about the most frightening thing about your practice is losing it, but providing a succession plan enables you to create financial stability for your family and estate.

It is one thing to create a practice and develop it. But, as with any other business, it becomes necessary to create succession plans. Just about the most frightening thing about your practice is losing it, but providing a succession plan enables you to create financial stability for your family and estate.

One of the most difficult decisions to think about is the transfer of your business - your pride, joy and most important, your creation. Turning over management/ownership authority is not easy for any founder, nor is it easy for the successor. However, if you want your practice to continue to prosper then you must seek a way to do it. Research shows that practices tend to fail after death and fewer than 30 percent are transferred successfully to a second generation or associate.

Getting Started

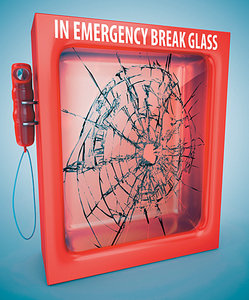

The first step in any transition is your ability to get your mind in the right context. Succession planning helps you prepare for two basic premises a) crisis and b) retirement. While there are very few statistics in each of these areas, I will bet that less than ten percent of most chiropractors are ready for these categories. The facts are these, one day your practice (heaven forbid) may get hit with a crisis and you will also need to or want to retire. When either occurs, what are your plans? There is an old maxim that says if you "fail to plan then plan to fail." This is very true. Operating a business where you are the sole focus has its positives as well as negatives. The benefits are the financial freedoms and lack of bureaucracy, but there are negatives as well. What happens if you are ill and you cannot bring in revenue or when you retire and you have not placed anything in savings? All this can and will harm you. It is for these reasons that planning is so beneficial.

Convincing chiropractors to have a disaster replacement plan in the event of a tragic event is not too difficult; persuading them to prepare people for advancement years ahead of their actual promotions presents more challenges. Therefore, replacement planning is a start, but only a start.

Consider that many succession plans pertain to most large organizations such as hospitals or healthcare administrators. Most small companies don't have one, much less replacements for key positions such as chiropractic assistants, therapists, associates, etc. Succession planning balances the short and long-term needs and promotes the simultaneous analysis of each.

So, if the stories above concern you and there is a desire to position the practice for continuity, what are some areas of consideration? Ask yourself the following:

- During a short-term illness who is responsible for maintaining the practice?

- Does the current team have enough training to continue practice standards when the principle is away?

- Should a crisis occur, who is my go to person?

- What areas of the practice are covered in a crisis and where is there vulnerability?

- Do I wish a one time payout or do I want an annuity if I retire from the practice?

- Do my siblings desire the practice in times of a crisis, death or retirement?

- What is my legacy? Do I want to leave one?

- What are my retirement and post treatment plans? Do I need a plan?

- Have I paid off my property or have I spent foolishly on needless items?

- What is my current debt to equity ratio?

As with any succession plan, using a professional approach is a key to your success. It is prudent to think about who might take over when you are incapacitated, die or become involved in some other crisis. The idea here is to provide on paper who will take over, what role they might fill, (not every successor need be a chiropractor) and what support and resource they will provide. However, not every chiropractic practice will have a family member ready, willing and able to takeover.