In the interview with "Dr. Gross" it is very clear that increased overhead can have a very serious effect on chiropractic practice profitability. This relationship between gross income, overhead and practice profit can be analyzed in order to better understand how they relate to each other. This is most easily performed using a "Break Even Graph."

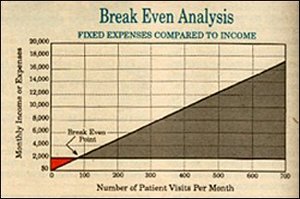

First we graph the practice overhead. Overhead costs are a combination of two kinds of expenses: fixed expenses and variable expenses. Let's begin with our fixed expenses at a low end of $2,000 per month. The amounts we will be using are for analysis only.

Notice that these expenses are generated regardless of how many patients visits occur or how much income is earned.

Because almost all expenses are fixed, we will avoid adding variable expenses at this point.

Next we add gross income. For simplicity's sake, we will assume that the practice income is set at $25 for each patient visit. This assumption will allow us to understand the relationships involved without having to create complicated graphs.

Notice the point where the gross income line and the fixed expense line intersect. This is the practice "break even point." Below this point on the gross income line, the practice is operating at a loss. Above this point on the gross income line this point that the practice. The amount of profit or loss can be measured as the distance between the gross income line and the fixed expense line.

At this point, one must see have at least 80 patient visits per month to break even. This does not include any profit for the doctor to live on.

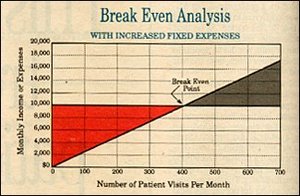

Let's assume now that the doctor is "advised" to increase his overhead in order to increase "practice growth." We'll move the fixed expenses up to $10,000 per month.

Notice how the break even point moves up and to the left. Now one must have at least 400 patient visits to keep from losing money.

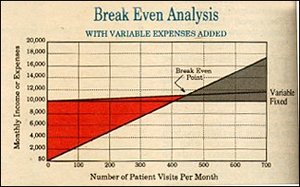

Finally, let's assume that our mythical practice is being advised by a practice consultant who charges a percentage (10%) for its services. This is 10% of the gross, not the net.

Notice that this ten percent fee is a variable expense, it varies with your income or the number of patients you see. A variable expense is added on top of the fixed expense. This moves our break even point again to the left, causing one to have to see at least 450 patients before one makes a profit. In addition, the variable expense limits the "profit cone." This is because the more money you earn, the greater the amount of variable expenses you have to pay.

As you can read in the interview with "Dr. Gross," the rising of one's break even point can cause a very real problem. This problem has basically two solutions.

A doctor can try to hang-on until he is no longer forced to pay the ten percent. This is what "Dr. Gross" has been able to do.

The alternative solution is very simple. A DC merely needs to increase the amount of money he receives from each patient. While this may allow the chiropractor to better cover his overhead, there is some question as to whether this is the the public's best interest.

There is also another question: Is this in the chiropractic profession's best interest?

Click here for more information about Donald M. Petersen Jr., BS, HCD(hc), FICC(h), Publisher.